A PROMINENT economist has called on Prime Minister Anwar Ibrahim to initiate reforms in the coming national budget which are apparently long overdue.

Failure would lead to a continuation in the stagnation of the economy, said Kamal Salih.

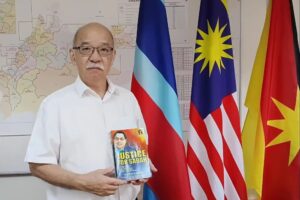

Now the chairman of the Fiscal Policy Institute, Kamal, who was a former member of the prime minister’s economic panel from 1981 to 1986, said that there needs to be an approach to reset the economy, taking it out of stagnation.

While lauding the growth numbers and the recent appreciation of the ringgit, Kamal echoed concerns that in the last survey, Malaysia lost seven positions in the World Competitiveness Index.

“We are sliding back instead of moving forward. In fact, our analysis of prospects for 2025 leads to concern that the Madani economic framework is in danger of being derailed, if the government fails to initiate serious fiscal reform measures in the coming budget.”

Kamal, who is a veteran on fiscal policies, said that it is not easy but the country must undergo reforms to ensure the economy is restored to a progressive trajectory.

“Malaysia cannot afford to have a weak manufacturing sector for many reasons. The recently imposed sanctions by the US on Malaysian semiconductor exports does not bode well for the future of our biggest industry which the government plans to expand further.”

As for agriculture being barely able to maintain a positive growth rate (though less than 3Q 2023), it must be emphasised that the lack of food security and high dependence on food imports, imply that the sector is grossly underperforming, said Kamal in a statement.

“Revenue in 1Q 2024 stands at RM70 billion. This is a 13.1% contraction from the previous quarter and a clear decrease from 1Q 2023 (RM76.2 billion). Without belabouring the point, more urgent measures have to be taken to raise government revenue.”

The Fiscal Policy Institute (FPI) takes the view that a structural reset of the economy cannot be delayed any further if the Malaysian economy is to perform closer to its potential.

If the right reforms are to be put in place in the immediate term, FPI’s preliminary forecasts indicate that the economy can achieve a whole-year growth of 5.0- 5.5% for 2024 and about 6% for the following year, he said.

There is an urgent need to re-introduce the GST possibly because of the threat of inflation due to the simultaneous implementation of subsidy rationalisation, set at a lower level of entry than 6%, he proposed.

This is also in order to plug the loopholes in the current SST, to complement the capital gains tax and the windfall tax already introduced.

With the anticipated growth of the digital economy, new financial charges may be considered in the upcoming budget to introduce a financial transactions tax, especially with the rise of digital payment systems.

FPI is of the opinion that the current attempt to rationalise subsidies is misguided for three reasons.

First, any subsidy rationalisation exercise can only be done delicately and in stages since subsidies are very much a part of the utility maximisation function of individuals.

Any attempt to execute the rationalisation rapidly will invite a backlash.

Second, the danger of a spike in inflation must be taken into account and the right institutional safeguards must be put in place, and an efficient rebate system for both small businesses and poor households.

Of prime importance will be the need to curb cartels and unscrupulous traders.

Third, subsidy rationalisation is best executed under conditions of greater global certainty and stronger consumer expectations.

These pre-conditions are unlikely to be obtained presently.

“It is for these reasons that FPI strongly advocates a re-introduction of the GST,” added Kamal. – September 8, 2024