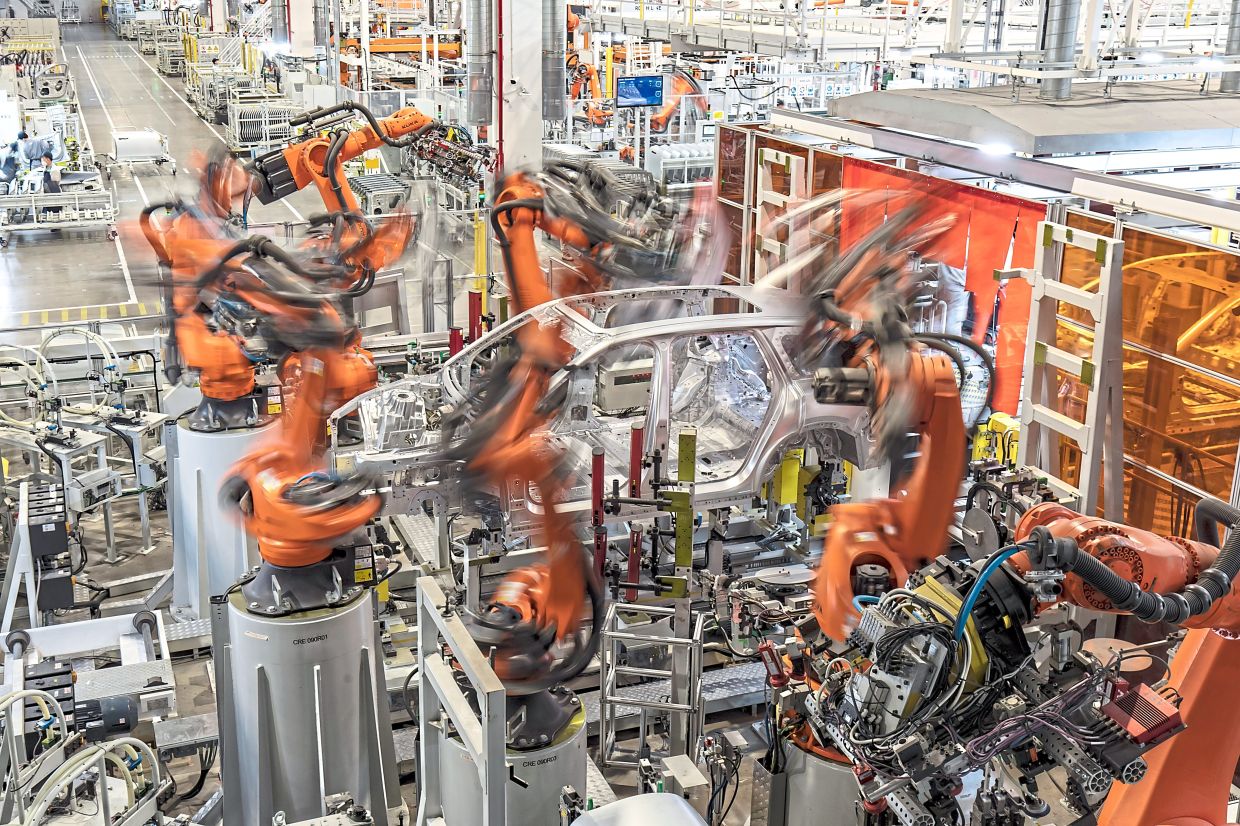

CHINA is making and installing factory robots at a far greater pace than any other country, with the United States a distant third – further cementing its role as the world’s manufacturing hub.

More than two million robots were working in Chinese factories last year, according to the International Federation of Robotics (IFR), a trade group for makers of industrial machines.

Nearly 300,000 new robots were installed in 2024, more than the rest of the world combined. By contrast, American factories added 34,000.

While Chinese plants have been using more robots, they have also grown far better at making them.

A combination of public capital, policy directives and generous loans has spurred Chinese firms to dominate robotics and related technologies, such as semiconductors and artificial intelligence.

Worldwide, robots are taking on an increasingly prominent and disruptive role in manufacturing.

These range from machines that weld car parts together to claws that lift boxes onto conveyor belts.

As technology improves efficiency, some factories are running with fewer workers, while others are reshaping roles entirely.

The long game

Over the past decade, China has pursued a broad campaign to integrate robots into its factories and become a major producer in its own right.

Analysts say the strategy mirrors Beijing’s national push in electric vehicles and AI.

“This is not a coincidence,” said Lian Jye Su, chief analyst at tech research firm Omdia. “It has taken many years of investment by Chinese companies.”

Factories in China have installed more than 150,000 robots annually since 2017. Manufacturing output ballooned in parallel.

By this year, Chinese factories were producing nearly a third of all goods worldwide – more than the United States, Germany, Japan, South Korea and Britain combined.

Robot installations actually fell in Japan, the United States, South Korea and Germany last year. Japan, the second-largest adopter, installed 44,000.

Beijing made robotics a top priority in 2015 under its “Made in China 2025” campaign, aiming to cut reliance on foreign suppliers.

Industries were given low-interest loans from state-controlled banks, funding for acquisitions of foreign competitors and direct injections of government money.

In 2021, China doubled down with a detailed national strategy for robot deployment.

“You can see how well that strategy worked out,” said Susanne Bieller, IFR’s general secretary. “Without a strategy, a country is always at a disadvantage.”

From imports to domestic dominance

China’s share of global robot manufacturing rose to a third last year, up from a quarter in 2023. Japan, the previous leader, fell from 38% to 29% over the same period.

Until recently, Chinese factories installed more imported robots than domestic ones. But in 2024, nearly three-fifths of the robots installed were made in China. Overall, China has five times as many factory robots as the United States.

The IFR’s data does not include humanoid robots – two-legged machines still mostly experimental.

Yet government support has spurred a boom in startups building them, along with an ecosystem of firms making components such as motorised joints.

Unitree Robotics, a humanoid startup in Hangzhou, has said it plans to go public by year’s end. Its latest basic humanoid robot costs around US$6,000 in China – a fraction of Boston Dynamics’ American-made machines.

Still, Chinese firms trail foreign rivals in producing high-end sensors and semiconductors needed for humanoids.

“If you were to assemble a really top-notch humanoid robot, it would be almost completely non-China-made,” said Lian. “Maybe one or two Chinese components, but by and large the entire system would be very international.”

Strength in numbers

When it comes to factory robots, however, China enjoys multiple advantages. It has an abundance of skilled electricians and programmers to install and maintain machines.

Even so, demand is strong enough that some specialists earn close to US$60,000 a year – a high salary by Chinese standards.

China’s AI industry also plays a critical role. Firms are developing tools to track and improve every aspect of machine performance.

“Companies here are using AI to swoop in and say which machines are doing great and which are a little off,” said Cameron Johnson, a Shanghai-based supply chain consultant specialising in automation.

“Outside of China, people aren’t looking at it as a manufacturing tool, at least not yet.”

With Beijing’s sustained backing, a swelling workforce of skilled technicians and a growing domestic supply chain, China is not just automating its factories; it is remaking global manufacturing in its own image. — ©2025 The New York Times Company

This article originally appeared in The New York Times.