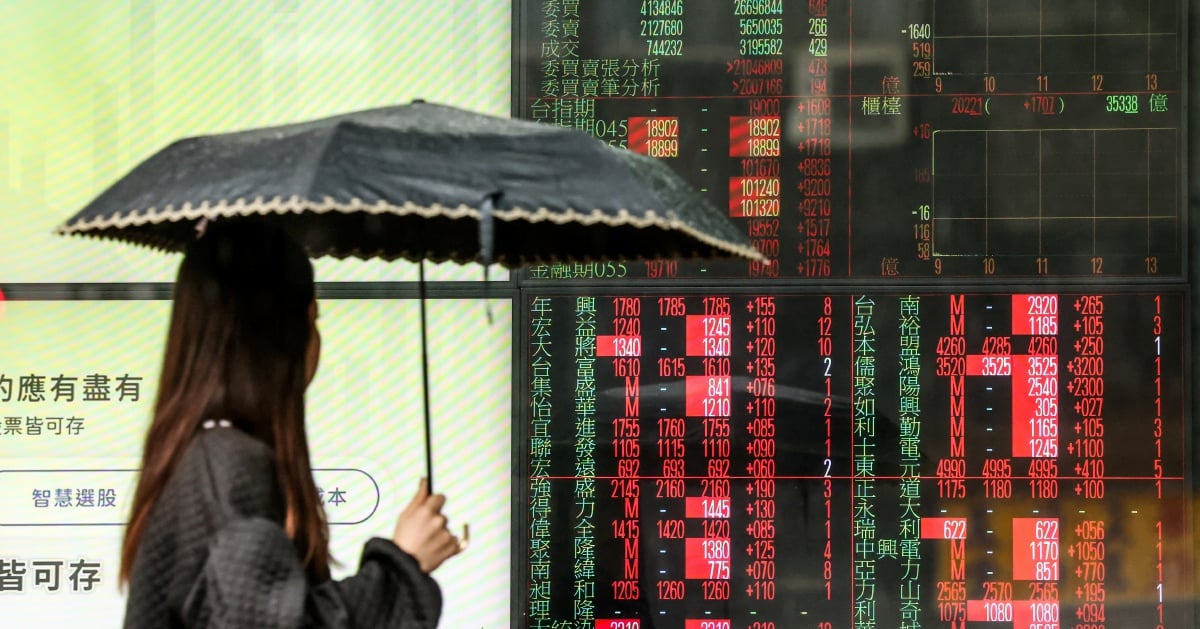

HONG KONG: Taiwan’s dollar led Asian currency declines on Friday, logging a seventh straight session of losses and putting it on track for its biggest weekly drop since Sept 2015, as foreigners sold local stocks and the island’s residents bought overseas bonds.

The Taiwan dollar fell 0.6 per cent to 30.682 per US dollar, its weakest level in more than three months. It has weakened more than 2 per cent in the past seven sessions. Stocks in Taipei fell 0.7 per cent on the day and were poised to lose more than 2 per cent this week.

The Indonesian rupiah fell 0.4 per cent, wilting for a fourth straight day, and was on track for its worst week since early-April. The Indian rupee gave up 0.2 per cent.

Asian equities largely traded higher, with those in Kuala Lumpur rising 0.3 per cent to a six-month high, while shares in Singapore added 0.5 per cent. Stocks in Seoul advanced 0.9 per cent and those in Bangkok added 0.9 per cent.

A gauge of emerging Asian equities, however, lost 0.8 per cent this week, snapping two straight weeks of gains. Persistent uncertainties over US President Donald Trump‘s policies towards foreign chipmakers and a Wall Street tech selloff have rattled investors this week.

Foreign investors sold TUS$69 billion (US$2.26 billion) worth of shares on Taiwan’s stock exchange on August 20 after a tech selloff on Wall Street, the Taiwan Stock Exchange website showed.

“Resident’s outbound investments through bond ETFs, which had slowed down in Q2 after the liberation day tariffs, have recently increased again. These investments are driving USD buying flows, leading to a higher USDTWD exchange rate,” said Chandresh Jain, EM Asia rates and FX strategist, BNP Paribas.

Among other currencies, the South Korean won and the Philippine peso were the only outliers, advancing 0.4 per cent and 0.3 per cent, respectively. The won, however, has lost 0.3 per cent so far this week.

Investors were spooked by a report this week showing 95 per cent of business AI pilots failed due to user learning gaps, driving the chip-heavy KOSPI down 2 per cent this week and triggering foreign outflows that weakened the won, said Wei Liang Chang, FX and credit strategist at DBS.

The US dollar index was up 0.2 per cent, on track for a nearly 1 per cent gain this week. Caution from Fed officials and inflationary data have led investors to pare bets of a jumbo-sized rate cut in September, with CME FedWatch now showing a 75 per cent chance of a 25-bp reduction, down from 92 per cent a week ago.

Investors were also bracing for Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium later in the day.

© New Straits Times Press (M) Bhd