This post is brought to you by AEON Bank.

If you’re looking for a solution to manage multiple financial commitments, be it an emergency financial support, family budget constraint, small renovation, vehicle repair or fixing your smartphone, and even a much-needed financial aid to bridge the temporary cashflow gaps, AEON Bank’s Personal Financing-i (PF-i) is the rescue you need.

AEON Bank is the first digital Islamic bank in Malaysia, licensed and regulated by Bank Negara and protected by PIDM. And now, PF-i is making it possible for salaried employees, self-employed individuals, freelancers and gig workers to access funds without complicated paperwork and branch visits. It’s Shariah-compliant and designed to provide an inclusive and hassle-free financing, from the application to fund disbursement, all managed via the AEON Bank app.

Flexible, Transparent, and Shariah-Compliant

AEON Bank’s PF-i offers a financing facility from RM1,000 up to RM100,000 with flexible tenure options ranging from 3 to 84 months, allowing for repayments tailored to individual budget needs. The Flat Profit Rate starting from 3.88% p.a. and a nominal Wakalah Fee of RM1 is applicable upon acceptance.

The financing facility is fully Shariah-compliant, providing an ethical solution that aligns with Islamic banking principles. Being collateral-free, it’s accessible to a wide range of Malaysians, including those with flexible or irregular income.

Who Can Benefit from PF-i

PF-i is developed for people who need flexibility in managing their finances, including gig workers, freelancers, and self-employed individuals.

Optimising a Risk-Based Pricing (RBP) framework to determine a competitive and personalised profit rate, AEON Bank ensures that anyone can apply for PF-i online if they are Malaysian citizens aged 18 to 55 with a minimum monthly gross income of RM2,500.

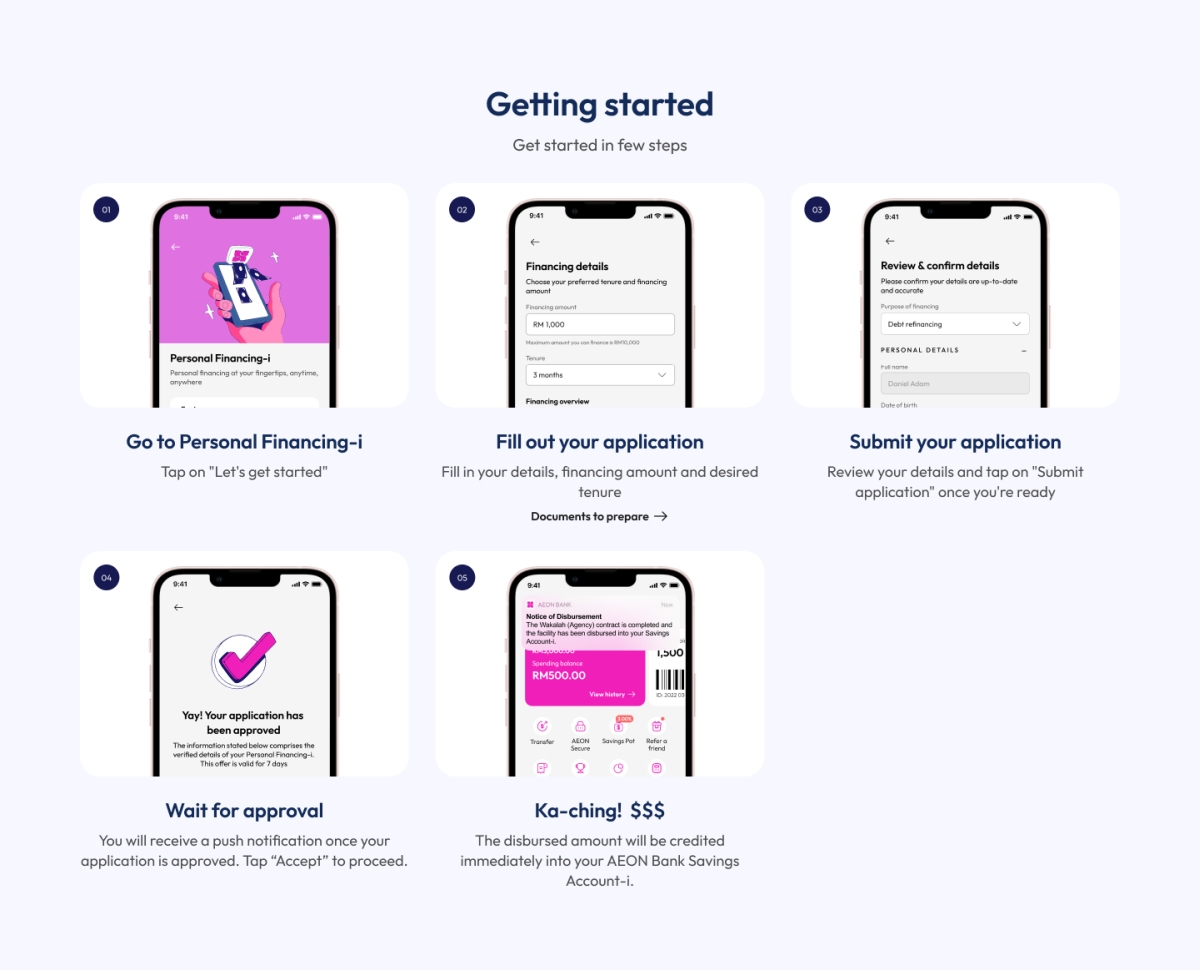

Easy, Fully Digital Application

Applying for AEON Bank PF-i takes place entirely online. Once you’ve downloaded the AEON Bank mobile app, you can complete your application in minutes without visiting a branch or dealing with mountains of paperwork. To apply for PF-i, just follow these steps:

Step 1: Activated Savings Account-i pre-requisite

Download the AEON Bank app and activate your Savings Account-i before applying for PF-i.

Step 2: Eligibility check and employment details

Applicants must be Malaysian citizens aged 18 and above, earning a minimum monthly gross income of RM2,500 – either as salaried employees, self-employed, freelancers or gig workers.

Step 3: Financing selection

Select the preferred financing amount ranging from RM1,000 to RM100,000 and flexible repayment tenure, with options between 3 to 84 months.

Step 4: Supporting document submission

Upload the latest EPF (KWSP) statement, reflecting the latest consecutive 6-month contributions (for salaried workers) or the latest consecutive 6-month bank statement (for self-employed/gig workers).

Step 5: Approval and fund disbursement

Applications will be processed immediately, and upon approval, funds will be disbursed directly into the applicant’s AEON Bank Savings Account-i. Repayments will be automatically deducted via monthly auto-debit.

Take charge of your finances with AEON Bank Personal Financing-i and scan the QR Code to download the AEON Bank app.