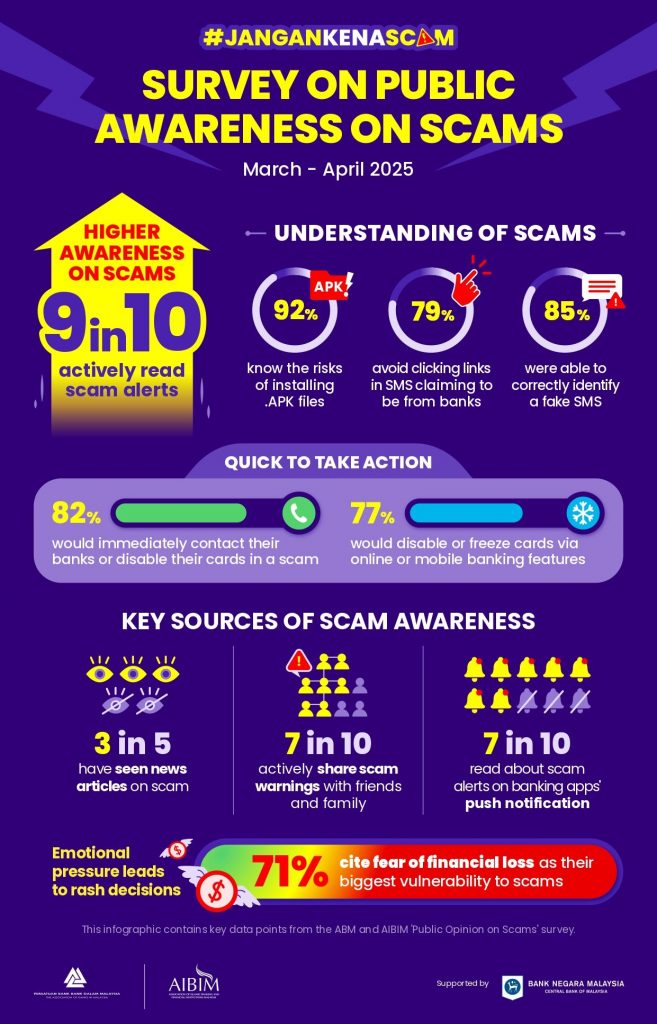

A new annual banking industry survey shows that Malaysians are increasingly vigilant when it comes to online scams. According to the latest findings, 9 in 10 respondents in Malaysia are actively reading scam-related alerts from their banks.

Commissioned by the Association of Banks in Malaysia (ABM) and the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM), the survey conducted by Rakuten Insight between March and April 2025 have gathered responses from 1,000 Malaysians nationwide. This is the third annual survey under the banking industry’s ongoing #JanganKenaScam public awareness campaign.

From the latest survey, it is shown that scam awareness efforts are not only reaching to the mass public, but it also encourages more people to be vigilant. 92% of respondents recognised the risks of installing unsolicited APK files, 79% would avoid clicking on links from SMS or emails claiming to be from banks, and 85% were able to correctly identify a fake SMS.

The survey also found that 82% of respondents would immediately contact their bank or disable their cards if compromised, while 77% would freeze their card through online or mobile banking tools—demonstrating growing preparedness in response to scam threats.

Chairman of ABM, Dato’ Khairussaleh Ramli said, “We are seeing a positive shift in public awareness and trust, but we also recognise that scammers exploit fear and urgency to bypass rational thinking. From the survey, we saw that 71% of respondents feared losing money if scammers’ instructions were not followed, as the primary factor in scam cases. Our responsibility as banks is not just to educate, but to help customers stay calm and make wise decisions under pressure. This means ensuring real-time safeguards are in place and accessible when it matters most.”

The survey indicates that bank apps have become a key communication tool—more than half of scam alerts were seen via banking apps, and 7 in 10 respondents said they read push notifications from their banks. Satisfaction with scam-related protection has also risen, with 76% of Malaysians saying they are satisfied with their bank’s effectiveness, up 13% from the previous year. Meanwhile, 3 in 5 respondents said their bank was helpful after a scam incident.

Beyond bank channels, social media platforms like Facebook and Instagram remain the most common source of scam awareness (52%). Encouragingly, 7 in 10 respondents also said they share scam warnings, particularly on WhatsApp, showing that the public is increasingly taking an active role in scam prevention.

President of AIBIM, Dato’ Mohd Muazzam Mohamed said, “The results indicate that our awareness efforts are yielding positive outcomes, but we must not become complacent. Scammers are constantly evolving their tactics, and our response must adapt in tandem. We want to equip Malaysians not only with information, but also with practical instincts and tools they can rely on in moments of uncertainty. As a sector, we are committed to ensuring that customers feel supported and protected every step of the way.”

However, knowledge gaps remain. Only one-third of respondents could correctly identify the role or emergency hotline of the National Scam Response Centre (NSRC). The banking industry is urging the public to report scam attempts quickly via the NSRC at 997 or through their respective bank hotlines to improve the chances of fund recovery.

To tackle scams, Banks in Malaysia have collectively implemented the following five anti-scam measures:

- Migrating from SMS OTPs to more secure authentication

- Tighter fraud detection and blocking mechanisms

- Verification and Cooling-off period for new device or service enrolments

- Restricting authentication apps to single device per account holder

- Dedicated 24/7 hotline for users to report incidents or suspicions of scam or fraud

The survey findings suggest that these measures are making a tangible difference, while reinforcing the importance of continued public education and industry collaboration.