More than 4.6 million EPF contributors have withdrawn a total of RM14.79 billion from their EPF Flexible account since the option was made available in May 2024, says Prime Minister Anwar Ibrahim.

Anwar, who is also the finance minister, said that as of June 30, the withdrawals involved 4.63 million contributors, or 35% of the 13.2 million EPF members under the age of 55.

“The (total) remaining balance in EPF Flexible accounts stands at RM10.16 billion,” he said in a written parliamentary reply.

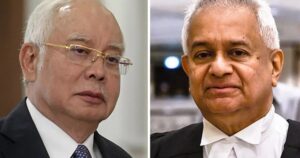

He was responding to a question from Shahidan Kassim (PN-Arau) on whether the government would allow 30% of savings from Account 1 to be moved to the EPF Flexible (Account 3) under a proposed special withdrawal scheme aimed at helping low-income Malaysians deal with the rising cost of living.

Anwar said such a move would go against the core purpose of EPF, adding that withdrawals from Account 1 were only allowed during the Covid-19 pandemic.

Under the EPF’s restructuring in May 2024, contributions are now split into three accounts: Retirement account/Account 1 (75%), Wellbeing account (15%), and Flexible account (10%).

Account 1 remains for retirement savings while Account 2 allows withdrawals for education, housing, and health.

Account 3, or the Flexible account, enables contributors to withdraw at any time in a move aimed at providing contributors easier access to their pension funds, especially during emergencies.

Anwar said the government remains committed to helping those in need with targeted subsidies, direct cash assistance, and special incentives already in place to ease the pressure on low-income groups.