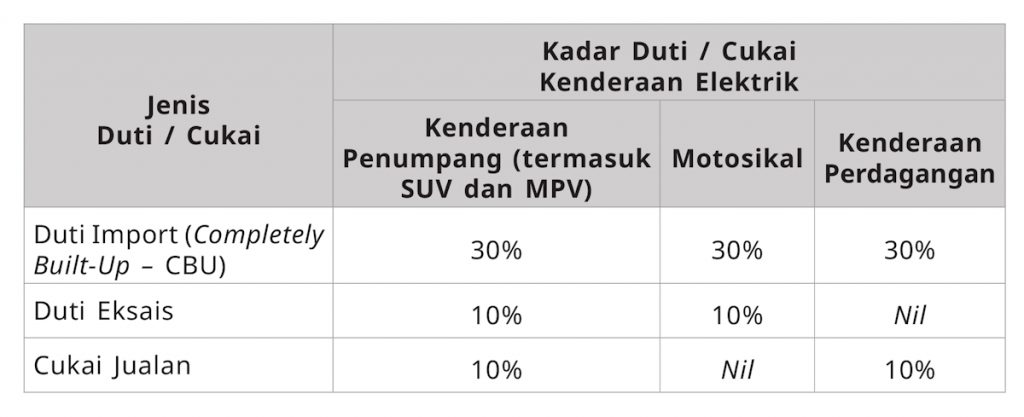

Tax exemptions on imported fully-assembled (CBU) electric vehicles will not be extended further. This is based on the information provided by the Ministry of Finance (MOF) through the newly published Fiscal Outlook and Federal Government Revenue Estimates 2026.

According to the report, indirect tax for 2026 is projected to grow by 8.9% to RM83 billion. Part of this growth is expected to come from the automobile industry, including EVs:

“…excise duties are anticipated to record RM12.8 billion, underpinned by moderate motor vehicle production, introduction of new vehicle models and intensified promotional activities, as well as the removal of excise duty exemptions on completely built up (CBU) electric vehicles beginning 2026.” – Ministry of Finance, Fiscal Outlook and Federal Government Revenue Estimates 2026.

At the moment, CBU EVs receive full exemptions from import duty and excise duty as well as road tax. Originally introduced during the tabling of Budget 2022, the exemptions were extended until 31 December 2025.

However, the report from MOF did not mention whether the import duty exemption on the CBU EVs will be abolished as well.

As a comparison, locally assembled (CKD) EVs are exempted from excise duty and sales tax until 31 December 2027. Components for CKD EVs are also exempt from import duty until the same date.

All in all, there are quite a number of things that are still unclear regarding the national EV policy at the moment. Hence, we believe that MOF as well as the Ministry of Investment, Trade, and Industry (MITI) need to step in as soon as possible to provide more clarification regarding this issue.