International sellers who wheel and deal on US-based online retailers such as eBay and Etsy are intentionally jacking up their shipping costs to the US now, and the reason is obvious: to deter Americans from buying their products and, ultimately, avoid dealing with the headaches brought on by President Trump‘s tariffs.

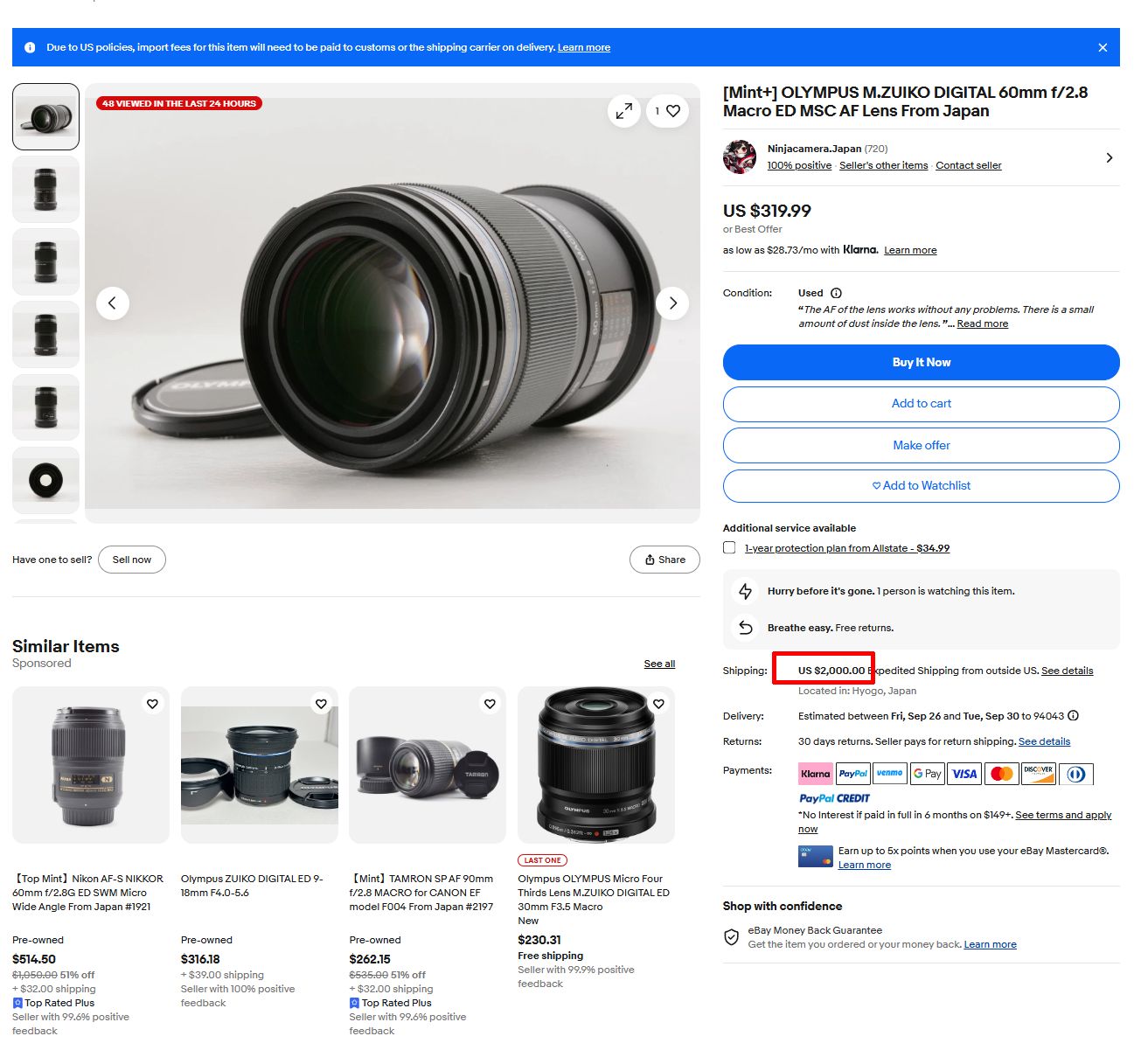

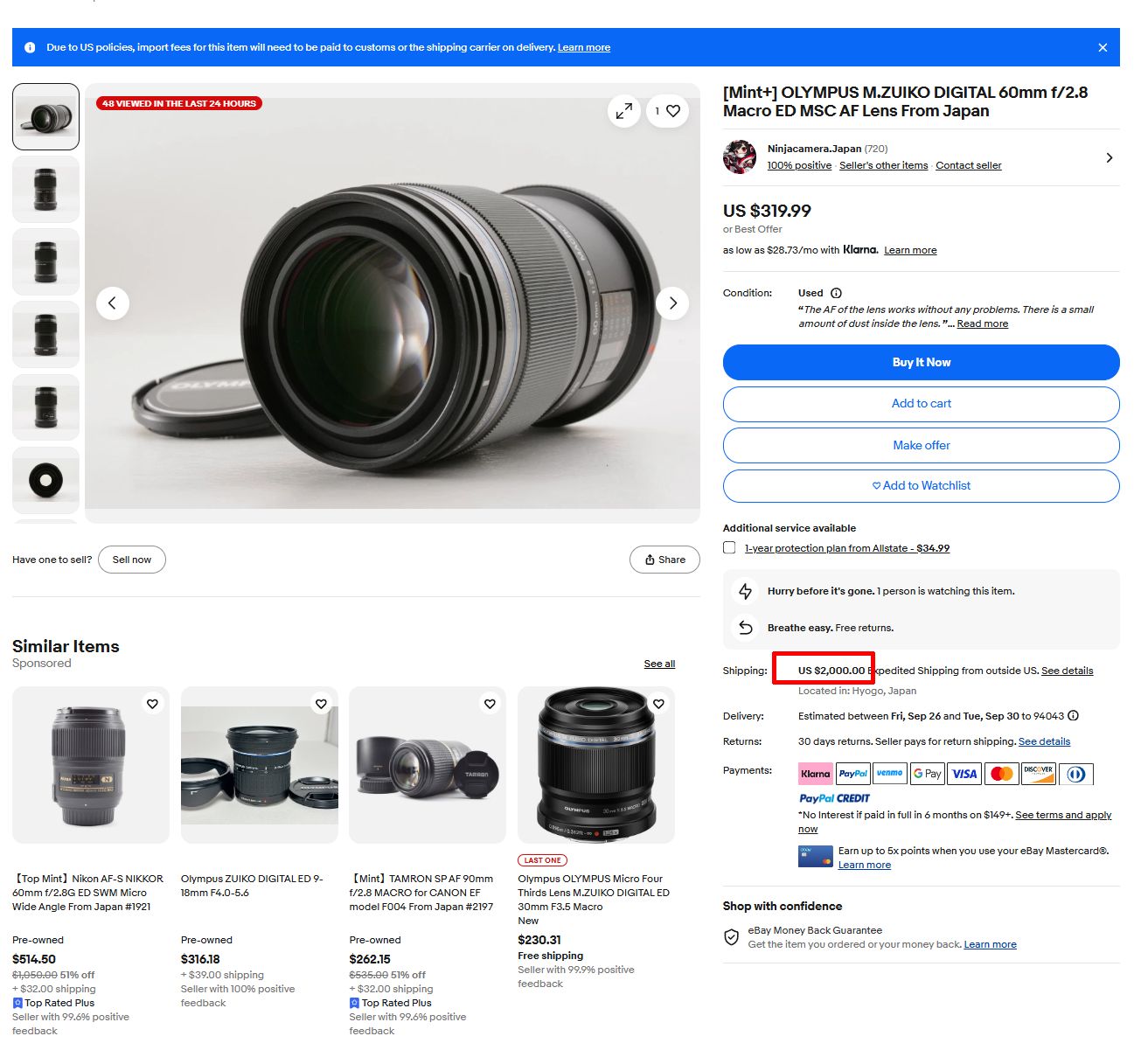

In the case of one eBay seller based in Japan, the entity increased the shipping cost of a US$319 (~RM1,342) to a whopping US$2,000 (~RM8,415), far exceeding the value of the lens itself. Meanwhile, the shipping costs to other countries such as the UK, Italy, Ireland, Costa Rica, Canada, and other countries, remain significantly less at around US$29 (~RM122).

This intentional bump in the shipping fee began when President Trump ended his country’s “de minimis” rule. That rule was a long-standing trade rule whereby goods with a value lower than US$800 (~RM3,366) could enter the country, both duty and tax-free, with expedited clearance. That rule was the backbone of the small business and enterprise model in the US, and afforded American consumers to purchase cheap goods from countries like China.

One customer in the US purchased a US$77 (~RM323) shirt from a Swedish brand and was charged an additional US$42 (~RM176) by FedEx, in addition to the US$30 (~RM126) he paid in shipping fees. Another example was a customer who ordered US$640 worth of replacement parts from Canada, and was hit with a US$1,200 (~RM5,049) bill listed as “government charges”.

Trump‘s decision to remove the de minimis exemption is very obviously a part of his ongoing trade war with China and, on a broader scope, other countries that he believes have taken advantage of the US’ good graces. However, he says that it was removed because his administration believes it allowed certain countries to bypass tariffs and therefore contribute to the current “trade imbalance” within the US.

It also doesn’t help that its removal has cause some confusion in the international shipping lanes, resulting in them suspending e-commerce shipments from overseas, until they update their systems to factor in the new charges. Some sellers usually pay the tariffs upfront to make the transactions as seamless for customers, while some simply pass it down to the consumer. At the end of the day, it’s the customer who bears the brunt of these import taxes.

(Source: Tom’s Hardware, 404 Media, WSJ)