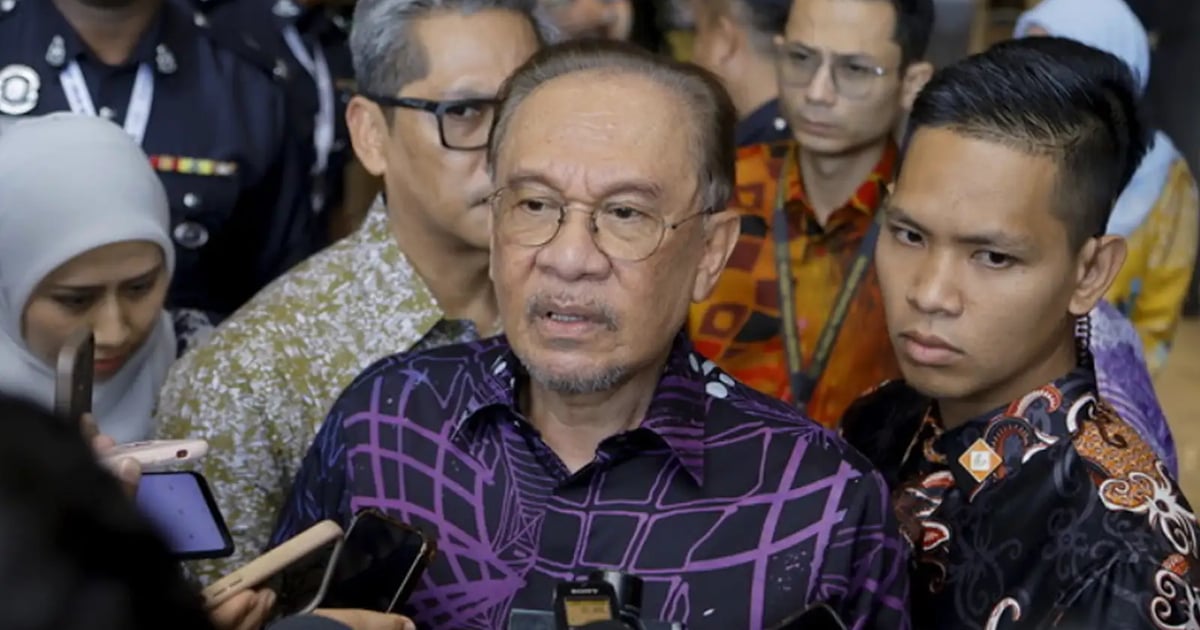

The government is considering a proposal to increase the tobacco tax, says Prime Minister Anwar Ibrahim.

Anwar, who is also the finance minister, said the proposal aligns with the government’s commitment to public health and fiscal reform, particularly given the long-standing moratorium on tobacco tax hikes.

Malaysia’s tobacco tax currently accounts for 58.6% of retail prices.

The country has no formal mechanism for periodic adjustments or revaluation of the rate, which was last increased in September 2014.

“I agree with the spirit of that proposal. I myself not only do not smoke, but also fully support anti-smoking campaigns,” he said in response to questions on whether the government may revise the tax in Budget 2026.

According to the parliamentary calendar, Budget 2026 is scheduled to be tabled in the Dewan Rakyat on Oct 10.

Anwar was speaking after attending a Budget 2026 engagement session here today.

Last week, when announcing the 13th Malaysia Plan, Anwar said the government would broaden its “pro-health” tax beyond sugary products to also cover tobacco, vapes and alcohol.

He said the expanded tax framework aims not only to increase revenue, but more critically, to encourage behavioural change and curb the rising prevalence of non-communicable diseases (NCDs).

NCDs, commonly associated with unhealthy lifestyles, include heart disease, stroke, diabetes and cancer.

Anwar said healthcare remains a key government priority, noting that the public system is under growing strain from medical inflation, the dual burden of communicable and non-communicable diseases, and an ageing population.