The Court of Appeal has unanimously ordered the re-transfer of 16 properties to two companies, ruling that the assets were unlawfully pledged as collateral to secure an illegal RM9.5 million loan.

Delivering the broad grounds of judgment, Justice Ahmad Fairuz Zainol Abidin said the property transactions were null and void as the loans – given by eight individuals and one company to AJ Kasturi Sdn Bhd and MA Joseph Capital Sdn Bhd – were illegal moneylending transactions.

“The Moneylenders Act 1951 exists to protect borrowers and cannot be circumvented,” he said in allowing appeals brought by AJ Kasturi and MA Joseph Capital.

The appeals court set aside a High Court ruling after the two borrower companies successfully established that the 16 sales and purchase agreements (SPAs) were a sham.

“The trial judge erred in law and facts, which warrants appellate intervention,” said Fairuz.

The bench also set aside judgment for vacant possession, outstanding rental and damages entered by the High Court in favour of the lenders on their counterclaim.

AJ Kasturi and MA Joseph Capital were also awarded general, exemplary and aggravated damages to be assessed by the High Court and RM320,000 in costs.

Fairuz said the trial judge was wrong to conclude that the transactions were genuine property sales dealings.

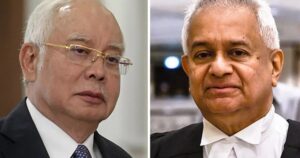

The panel was chaired by Justice Nazlan Ghazali, with Justice Faizah Jamaludin sitting as its other member.

According to the facts of the case, the two companies had wanted to raise funds urgently for a property acquisition in 2014 after their application for a bank loan was rejected.

A representative of the companies then approached lawyer M Pannirselvam who offered to arrange a loan with interest charged at 4% per month.

The companies agreed and pledged the properties progressively as security for the loan.

The lawyer and the lenders relied heavily on an instrument called a “letter of option” which the appeals court held was questionable and defied commercial logic. The “letter of option” was not executed by the lenders.

The company repaid the loan in part but subsequently defaulted, whereupon the lawyer facilitated transfers of the properties to the lenders.

Dissatisfied, the companies filed three suits to recover the properties, all of which were dismissed by the High Court, giving rise to the present appeal.

Lawyers Hariharan Tara Singh and Tan Eng Seng represented the companies, while counsel R Thayalan appeared for the lawyer.

Ringo Low and Faiz Abdul Rahim appeared for the lenders.