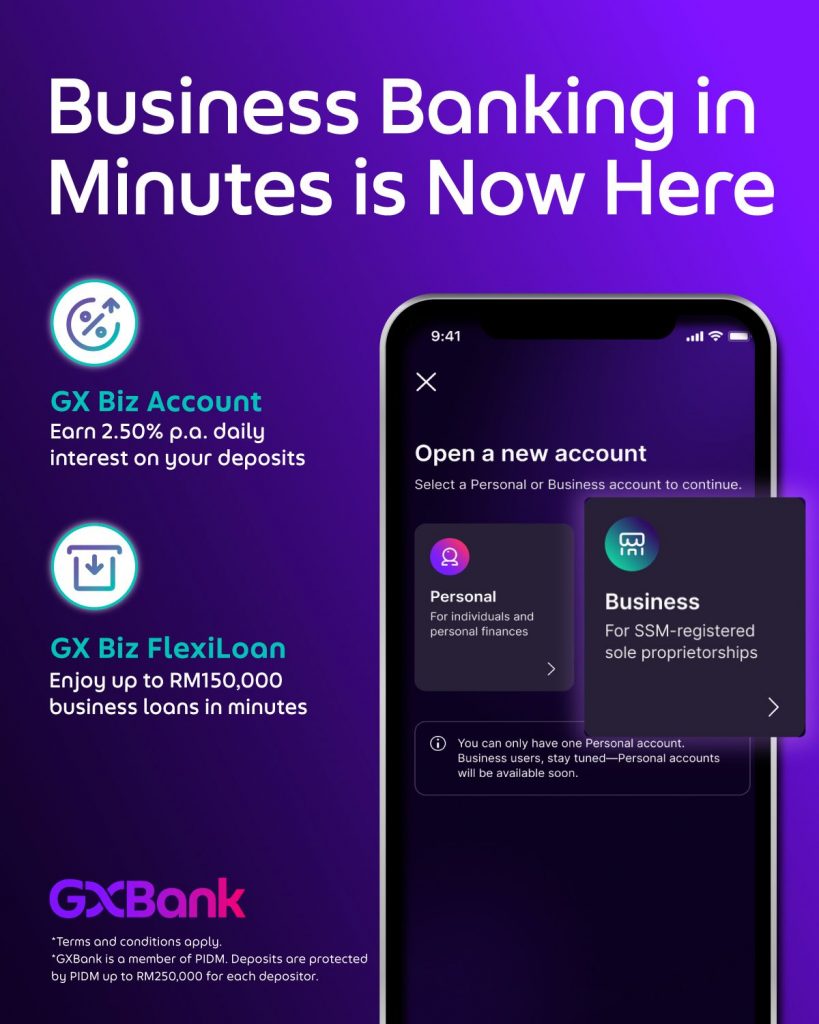

GXBank has rolled out its Business Banking service which aims to provide Micro, Small and Medium Enterprises (MSMEs) with accessible and flexible financing with savings. GX Business Banking is rolling out first to sole proprietors with innovative and fully digital solution specially designed to address the pain points of small business owners.

GX Business Banking currently offers a GX Biz Account which provides daily interest up to 2.5% p.a. and a GX Biz FlexiLoan which provides instant access to credit up to RM150,000.

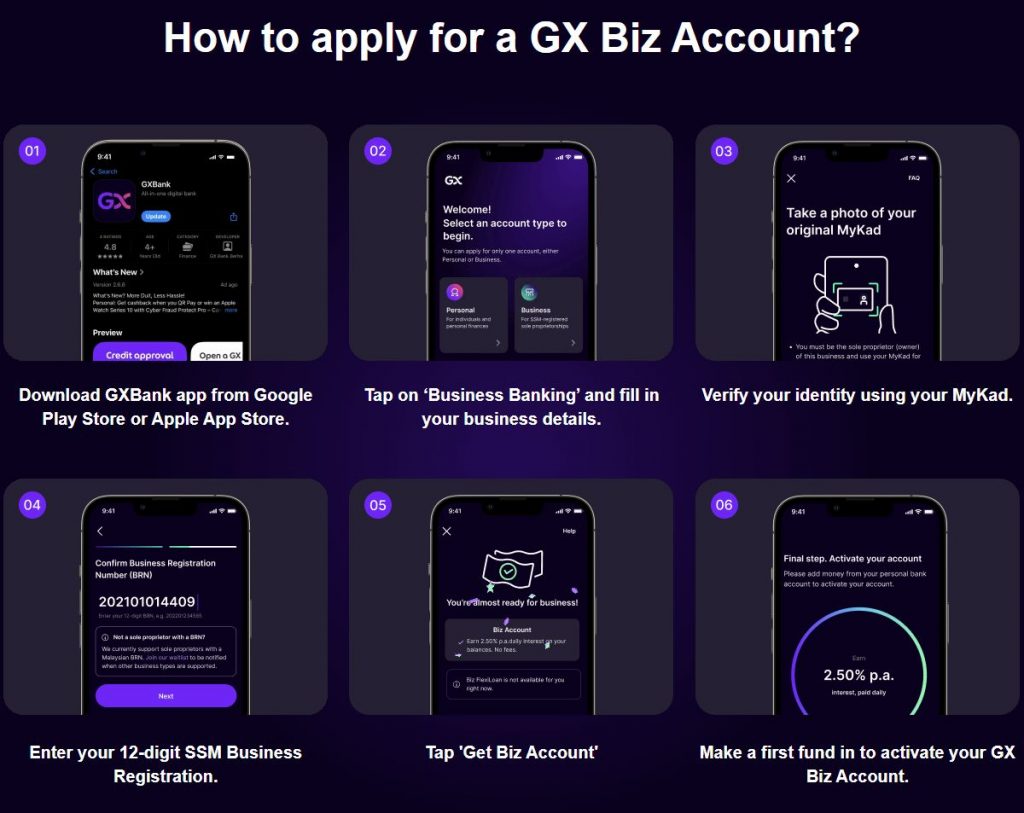

According to GXBank, small business owners can apply for a GX Biz Account in under 8 minutes minutes with no physical paper work required. It is open to Malaysian citizens (MyKad holder) who are sole proprietor (owner) of a business that’s registered with Suruhanjaya Syarikat Malaysia (SSM). You will need your MyKad and your 12-digit Business Registration Number (BRN) to sign up.

With GX Biz Account, small business owners can enjoy daily interest of 1% per annum (p.a.). In addition, GXBank is also offering up to 1.5% p.a. additional bonus interest for GXBank ecosystem partners, until 30th September 2025.

To provide business owners access to growth capital, GX Biz FlexiLoan offers instant and flexible loan of up to RM150,000. The loan facility offers instant approval, subject to eligibility and credit assessment. GXBank says there are no hidden charges on loan application or utilisation, and MSMEs can enjoy the benefits of daily rest interest reducing balance, where businesses can save on interest for early loan settlement.

The daily rest interest is calculated based on the outstanding loan balance of the end of this day. So if a payment is made (for both regular instalment or additional principal reduction), it will reduce the interest charged from the very next day.

According to GXBank, there are zero monthly and transaction fees, and there’s no minimum balance required. GXBank is also a PIDM member and deposits are protected up to RM250,000 for each depositor. They also provide 24/7 customer support for business owners.

To get started, you can download the GXBank app which is available on the Apple App Store and Google Play Store. If you’re an existing GXBank Personal Account user, you can also sign up for a Business Account by tapping on your profile name on the top left and then click on Business.

In conjunction with the recent Hari Kebangsaan and Hari Malaysia, GXBank has also kicked off Jaguh Niaga which aims to empower 10,000 MSMEs to thrive in a digital-first economy. The programme provides local business owners inclusive financing via GX Business Banking and access to a suite of digital business tools to help them grow. This include expanding their customer base via Grab platform, HR management solutions and digital payments, through partnerships with local companies including startups from GXBank’s TeXnovasi programme such as du-it, Swipey and PulseLink.

GXBank CCO (SME), Prasanna Rao, said, “We first piloted GX Business Banking with Grab merchant-partners, and their feedback and response was overwhelmingly positive, especially the unparalleled convenience and additional savings. They appreciated that approval for a business loan is in minutes with instant access to cash. Similar to our retail deposits, business owners earn daily interest on their GX Biz Account. For GX Biz FlexiLoan, they can choose flexible repayment terms of up to 3 years, with no penalty for early settlement, and also, earn interest charge reduction on their loan repayments. Additionally, their feedback allowed us to refine our products – from improving our credit models to approval speed, and data-fraud prevention.”

Naim Zahrul, owner of Smashey’s Gourmet, who is also one of the pilot merchants shared, “GX Business Banking feels purpose-built for entrepreneurs like me—practical, user-friendly, and financially flexible. It makes the stress of managing inventory purchases and the burden of monthly interest. The end-to-end process of signing up, applying for the GX FlexiLoan, and making repayments is seamless, leaving me more time to focus on running my business and making delicious burgers for my customers!”

For more info, visit GXBank’s Business section.