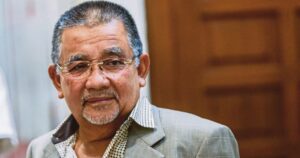

KUALA LUMPUR: The government made the decision to maintain the Sales and Service Tax (SST) with an expanded scope after considering both SST and the Goods and Services Tax (GST), according to Finance Minister II Datuk Seri Amir Hamzah Azizan.

He said the government acknowledges that both consumption tax systems have their advantages and disadvantages, but the expanded SST has been designed to be targeted and progressive to ensure that the tax burden is distributed more fairly and borne by those with the capacity to pay.

“Among the key basic considerations were system readiness and swift impact, targeted approach and manageable effects compared to the broad-based nature of GST, and SST allowing the MADANI Government to take a more progressive approach by setting a more focused taxation scope,” he said while wrapping up the debate on the 13th Malaysia Plan for the Finance Ministry (MoF) in the Dewan Rakyat today.

Amir Hamzah also noted that although GST provided a list of exemptions and zero-rated items, the number of items is smaller compared to that of goods and services exempted from SST.

He also explained that the government expects to generate an additional collection revenue of RM5 billion in 2025, and RM10 billion for the full year 2026.

“The increase in revenue from the SST expansion will be used for continued investment in improving the social safety net system for the people’s well-being.

“As an example, the allocation for the Sumbangan Tunai Rahmah (STR) and Sumbangan Asas Rahmah (SARA) programmes has been increased from RM10 billion in 2024 to RM15 billion in 2025 to assist citizens in coping with the cost of living challenges,” he added.

Touching on the carbon tax, Amir Hamzah said the government plans to introduce a carbon tax in 2026 as part of its commitment to achieving net-zero carbon emissions by 2050.

“In the initial phase, it will focus on the iron, steel, and energy sectors, which are the main contributors to greenhouse gas emissions,” he explained.

Amir Hamzah said the MoF is currently studying international best practices, including those from Norway, the United Kingdom, Canada, South Korea, Japan, as well as countries in this region such as Singapore and Indonesia which have implemented or are in the process of implementing carbon tax and emissions trading schemes.

“The carbon tax implementation framework will be aligned with the country’s climate change policy and carbon market while also taking into account measures that have started to be implemented such as the retargeting of fossil fuel subsidies,” he said.

© New Straits Times Press (M) Bhd