PUTRAJAYA: The government is considering a proposal to raise the tobacco tax to between 60 per cent and 70 per cent of retail prices.

Prime Minister Datuk Seri Anwar Ibrahim, who is also the finance minister, said the proposal was consistent with the government’s health reforms.

“I agree with the spirit of the proposal,” Anwar said when asked about the proposal. “I don’t smoke, and I fully support anti-smoking campaigns.”

Anwar was speaking to reporters after attending the first engagement session for Budget 2026 with almost 300 stakeholders.

Malaysia’s current tobacco tax, which has not been revised since September 2014, accounts for about 58 per cent of retail prices. The country has no formal mechanism for periodic reviews or increases.

Last week, Anwar said the government would expand its pro-health tax framework to include tobacco, vape products, and alcohol, beyond just sugary drinks, under the 13th Malaysia Plan (13MP).

He said the move was aimed at increasing revenue and driving behavioural change to reduce the growing burden of non-communicable diseases (NCDs) such as diabetes, stroke, heart disease, and cancer.

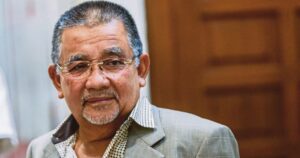

Health reforms are expected to be a key focus in Budget 2026, which will be tabled on Oct 10, according to Finance Minister II Datuk Seri Amir Hamzah Azizan.

© New Straits Times Press (M) Bhd