KUALA LUMPUR: Gagasan Nadi Cergas Bhd has secured shareholders’ approval to acquire a 69.4 per cent stake in Konsortium PAE Sepakat Sdn Bhd, a company that manages student hostels across seven polytechnic campuses.

Under the RM127.3 million deal, Gagasan Nadi will acquire 100 per cent of Serata Ehsan Sdn Bhd and a 45 per cent stake in Seri Delima Anggun Sdn Bhd, giving it effective control of Konsortium PAE.

The acquisition received approval from the Public Private Partnership Unit of the Prime Minister’s Department in September, the company said in a statement.

The group will partly fund the acquisition through a Sukuk Wakalah facility of up to RM330 million, arranged by Maybank Islamic Bhd.

The facility has a tenure of up to 12 years, with tranches ranging from one to 12 years.

Konsortium PAE’s portfolio includes student hostels at campuses in Banting, Ipoh, Port Dickson, Johor Bahru, Seberang Prai, Jeli, and Kota Bahru under concession agreements signed with the Malaysian government in 2013, which run until 2036.

Gagasan Nadi said the acquisition is expected to be earnings-accretive, adding RM155.2 million to its facility management order book, generating a bargain purchase gain of RM33.2 million and an additional annual income of RM19 million before finance costs.

Part of the Sukuk Wakalah proceeds will also support the group’s property development arm, which aims to deliver 15,000 affordable housing units across four townships in Selangor with a combined gross development value (GDV) of RM4 billion over the next eight years.

Other projects in Ulu Yam and Serendah, with a combined GDV of RM674 million, will also provide steady in-house work for its construction segment.

Maybank Investment Bank Bhd is the principal adviser for the acquisition.

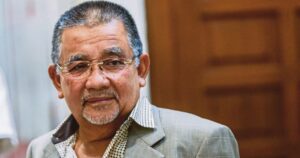

Gagasan Nadi group managing director Datuk Wan Azman Wan Kamal said the takeover would expand the group’s concession and facility management segment, which provides consistent recurring income.

“This acquisition brings in a well-established concession portfolio that will boost our recurring revenue through stable, long-term cash generation.

“Meanwhile, the recent establishment of the Sukuk Wakalah facility is a strategic initiative that will support Gagagsan Nadi Cergas’ acquisition of a major facility management concession while optimising financing costs,” he said.

© New Straits Times Press (M) Bhd