KUALA LUMPUR: Bank Negara Malaysia says the temporary 10 per cent cap on health insurance premium adjustments is working effectively in managing rising medical costs.

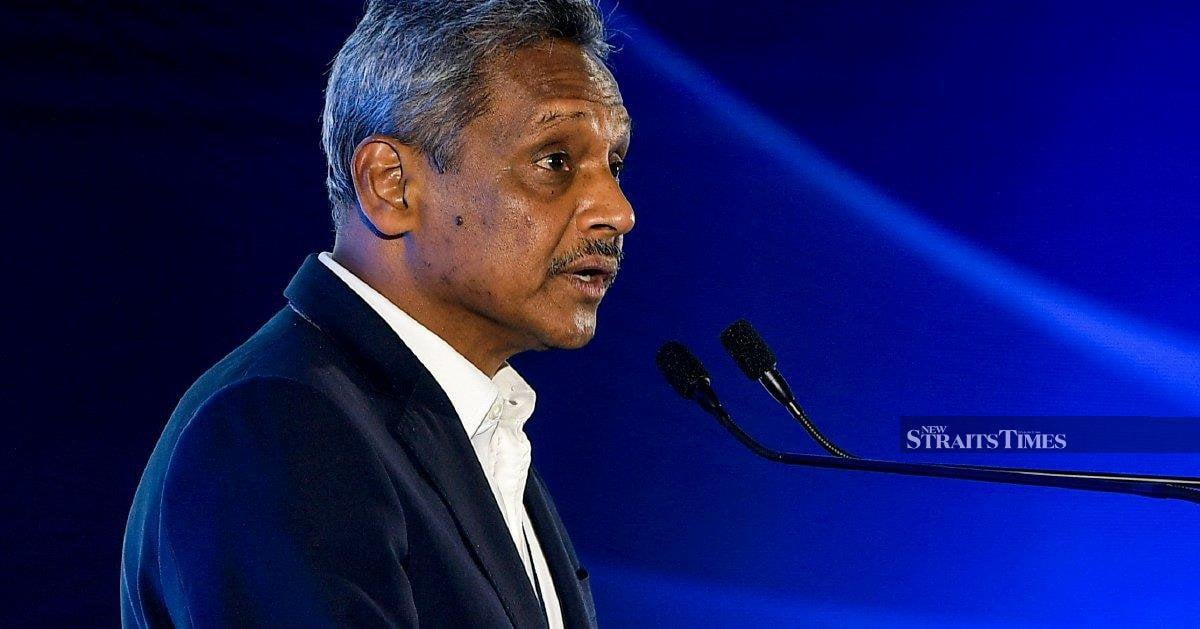

Bank Negara governor Datuk Seri Abdul Rasheed Ghaffour said the measure, which currently covers about 90 per cent of health insurance premiums, acts as an initial buffer to ensure increases remain manageable.

“In the short term, we have introduced a 10 per cent limit in terms of repricing, and we have seen this work very well. This 10 per cent repricing adjustment covers about 90 per cent of insurance premiums.

“The data reflective of 14.7 per cent inflation reflects price increases, possibly due to new products introduced recently, so it does not directly reflect the 10 per cent repricing adjustment,” he said.

The governor said the central bank’s longer-term focus remains on implementing the RESET initiative, which aims to revamp the medical and health takaful product, enhance price transparency, strengthen digital health systems, expand cost-effective treatment options, and transform payment mechanisms.

“These are the broad strategic directions we have introduced and are currently implementing.

“We plan to finalise the design of the base product by this year, and start a pilot next year. Once this is in place, premium increases can be better managed,” Abdul Rasheed said.

© New Straits Times Press (M) Bhd