KUALA LUMPUR: ASEAN cannot rely solely on foreign direct investment but must develop and invest in its own technology companies to progress.

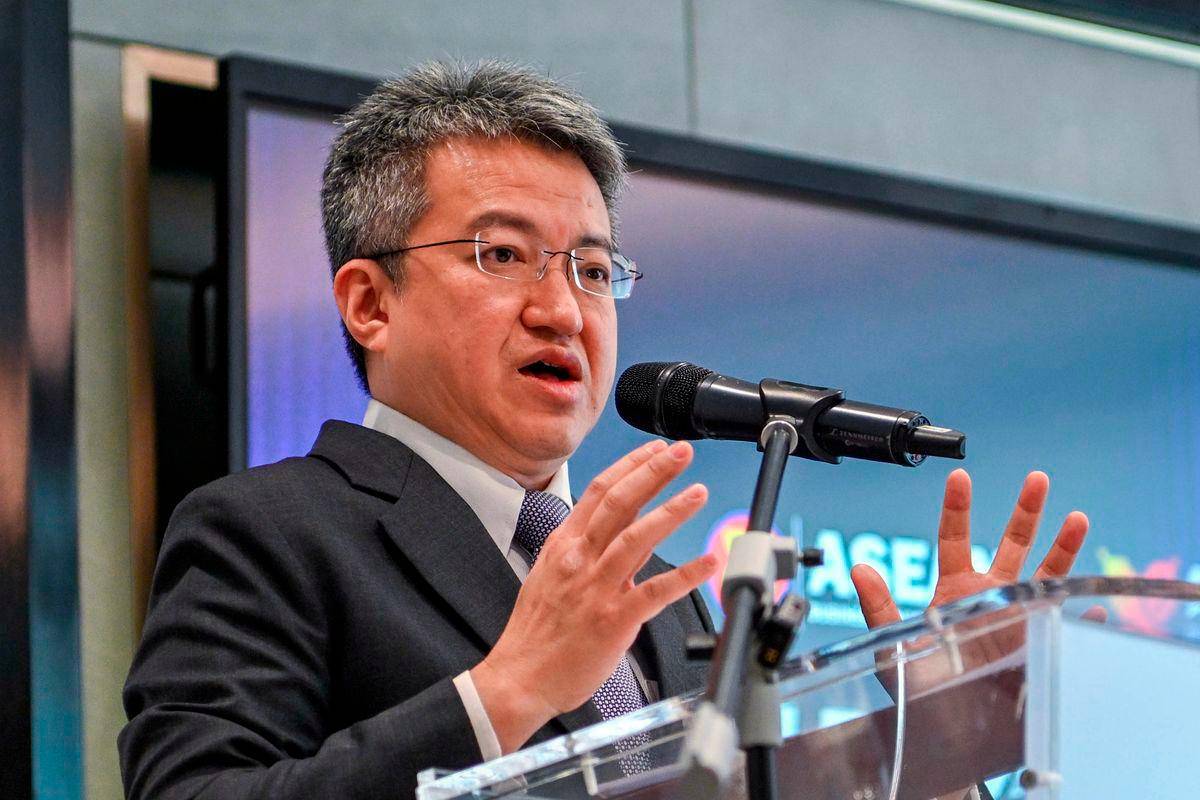

Deputy Investment, Trade and Industry Minister Liew Chin Tong addressed the misconception that technology must come from outside while ASEAN serves merely as a production site.

“If we have a lot more investment going into ASEAN technologies, we will eventually see the companies emerging as regional MNCs or even global MNCs,“ Liew stated during a press conference after establishing the ASEAN Private Markets Council.

He emphasised the need to connect funding, technology, and industrial policy to create a robust market within ASEAN.

The ASEAN Private Markets Council originated from one of twelve initiatives led by the ASEAN Business Advisory Council to overcome structural barriers in private capital development.

These barriers include fragmented regulatory frameworks, underdeveloped local fund managers, and limited large-scale capital deployment opportunities.

Over twenty leading private financial market institutions across key ASEAN economies have committed to joining as founding members.

Liew highlighted that the council aims to unlock regional investment potential, particularly in technology and green transition initiatives.

He expressed hope that investments would support ASEAN’s green transition through new technologies, solutions, and innovative processes.

The initiative should also involve blended financing for the ASEAN power grid to ensure energy reaches all parts of the region.

ASEAN-BAC Malaysia chairman Tan Sri Nazir Razak cited a McKinsey study showing ASEAN private markets at only 0.5% of GDP compared to the global average of 1.5%.

He estimated that up to $60 billion in capital is needed for ASEAN private equity and venture funds to match global growth averages.

Nazir outlined the council’s mission to strengthen ASEAN as a globally recognised hub for private markets by integrating capital flows and enhancing governance.

The council will promote ASEAN globally, engage capital allocators, reduce regulatory friction, and broaden participation beyond primary hubs. – Bernama